The new fiscal year is underway and the first sales tax numbers are in for the City of Guthrie.

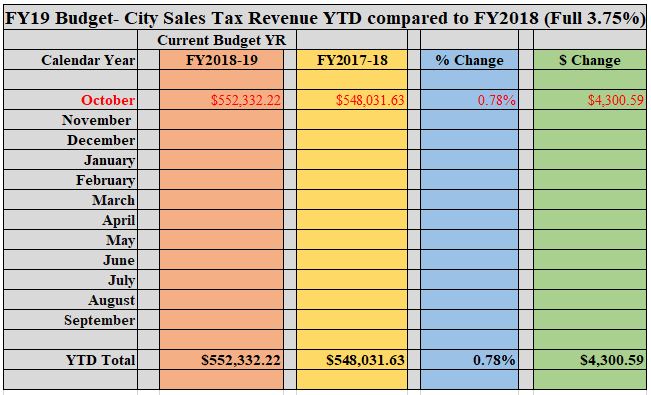

October collections came in at a total of $552,332.22, which is .78 percent higher ($4,300.59) compared to October 2017.

The City’s sales tax is 3.75 percent with three percent going toward the General Fund and .75 percent to the Capital Improvement (CIP) Fund.

In February 2016, Guthrie voters approved a three-quarters sales tax with a 15-year (June 30, 2031) sunset clause for capital improvements.

In the last fiscal year (2018), the City finished 8.93 percent higher, accumulatively, as compared to 2017, or $555,927.30.

Be the first to comment on "City’s fiscal year begins with a slight increase in sales tax dollars"