Sales tax numbers continue to be encouraging for the City of Guthrie.

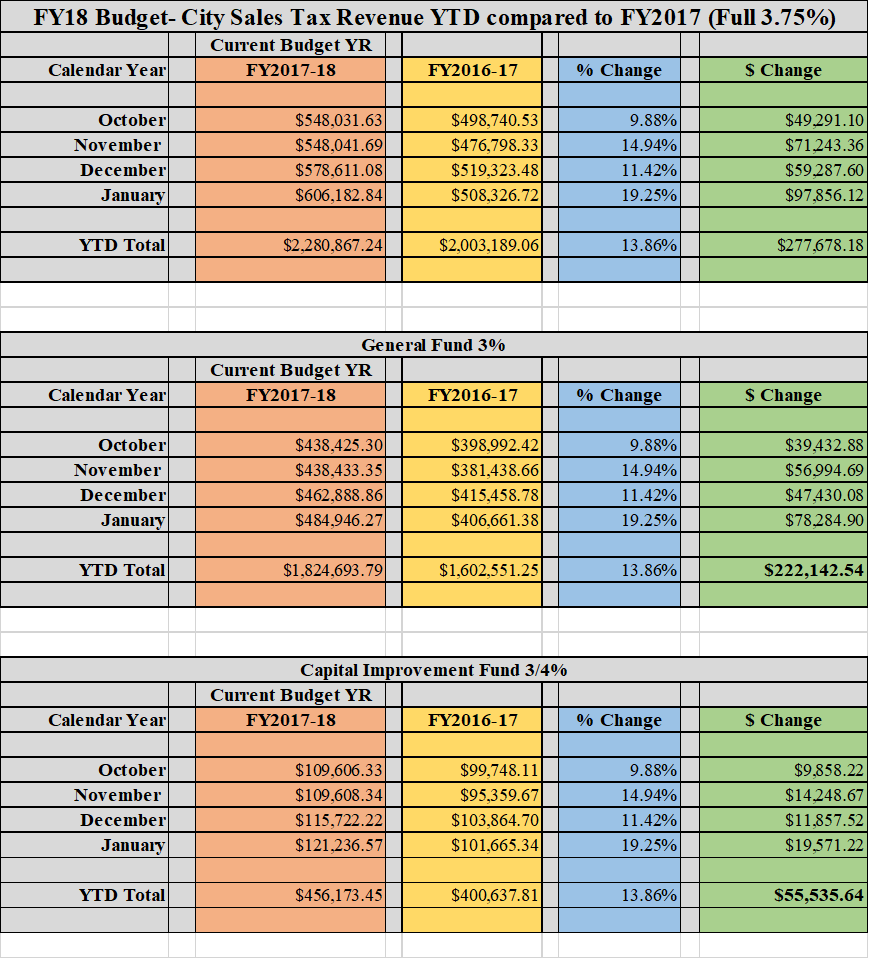

The City receives 3.75 percent on all sales within the city limits. Three percent goes to the General Fund and three-quarters of a penny (.75) goes to the Capital Improvement Fund.

Compared to the previous fiscal year, the first four months of this fiscal year is up 13.86 percent.

October begins each fiscal year for the City, and through January the City has brought in a total of $2,280,867.24, which is an increase of $277,678.18 compared to the same period a year ago.

Of the total, $1,824,693.79 went to the General Fund and $456,173.45 to the Capital Improvement Fund.

The General fund shows an increase $222,142.54 while the Capital Improvement Fund has increased $55,535.64 from a year ago.

Last year’s sales tax generated $6,222,019.48 (fiscal year 2016-17). If sales receipts continue at the current rate, the City could generate approximately $7 million in sales tax.

The biggest jump in collections came in the month of January, which represents actual sales in December, with an increased 19.25 percent ($97,856.12).

With legislation on the state level, cities now collect sales tax from online giant Amazon. While those numbers are not available, it has played a factor in sales tax collections for all cities and the state.

In May 2017, the City adjusted their budget after they announced they were projected to spend more money than the anticipated revenue.

The City realigned staff, including cutting and eliminating positions. Seven positions were left unfilled, including three firefighters, one police officer, economic developer, line equipment operator and a maintenance worker. Other positions were transferred within departments.

Be the first to comment on "Sales tax numbers continue to rise for City of Guthrie"